Introduction #

This data was extracted from Root’s website: https://root.vc on August

8th, 2024. It is the result of cross referencing the tldr of their

portfolio companies with Crunchbase. Note there are some discrepancies

between the 51 companies they list online and the 92 investments they

have made according to Crunchbase. I can’t tell if these are additional

rounds, an out-of-date website, smaller investments that didn’t make the

site or some other cause.

A first cut at the data #

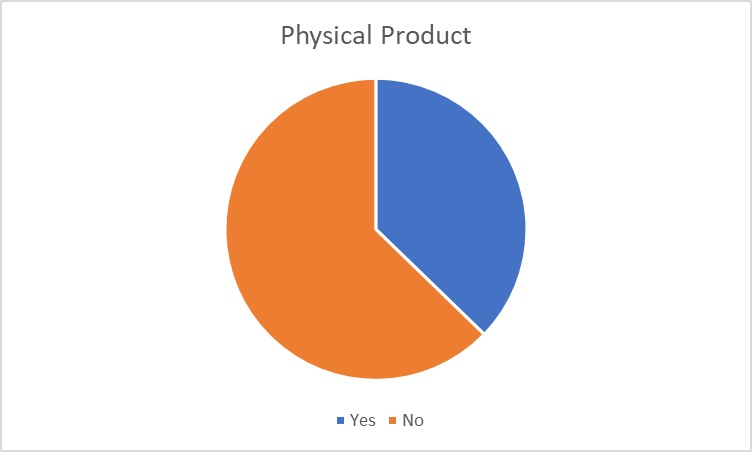

Although Root invests in hardware companies, they don’t solely invest in hardware companies. Looking through their 51 website-listed companies and making a best guess on which do and do not sell their own physical products, it looks like 19 (37.3%) have physical products.

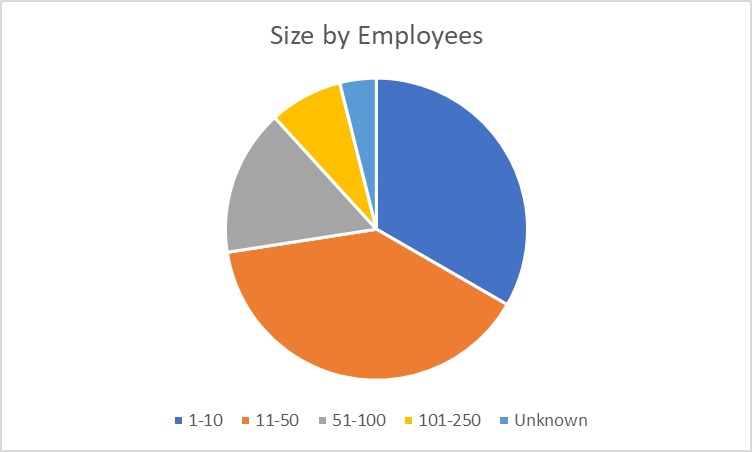

Moving on from the products, how big does Crunchbase think the portfolio companies are? There are going to be some further inaccuracies here because for two of the companies, I was unable to locate good LinkedIn or Crunchbase summaries. Of the 49 companies that can be analyzed, 3/4ths of them are either in the 1-10 or the 11-50 employee groupings. No portfolio companies exceed 250 employees.

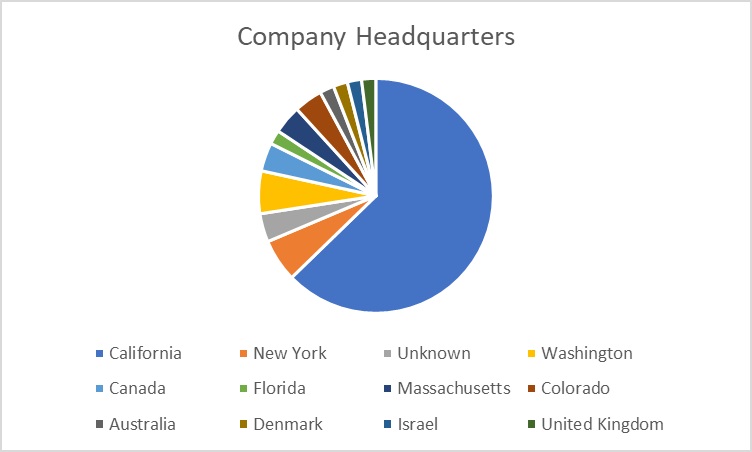

For a final high-level look at the portfolio, lets answer the question of whether these companies are all California-based since this is a very common headquarters location for startups in America. Unfortunately in Root’s case - more than 60% of their companies are California-based with the rest being a hodge-podge of locations ranging from Boca Raton, Florida to Australia.

Personal opinions - Job prospects #

Moving on from objective breakdowns of the portfolio companies - if someone who valued physical products and innovation and simultaneously had zero interest in moving to California, what companies does Root have in their portfolio that meet these criteria? It turns out to be only four companies:

- Nordsense in Copenhagen, Denmark who make trash bin sensors that connect to cellular networks

- Thruwave in Seattle, Washington who make mmWave package inspection systems

- Tortuga Agtech in Denver, Colorado who make farming robots with an emphasis on harvest

- Versatile AI in Boca Raton, Florida who make hardware for monitoring cranes at construction sites

And as of today (August 22nd, 2024), only one of these companies has a position in hardware engineering (Thruwave), and that is for a relatively inexperienced spot at 2+ years’ experience. Tortuga has a field technician position but that is based in California - violating one of the original criterion for this filter.

Personal opinions - SW for HW engineers #

Two of the companies in Root’s portfolio do not provide physical products but they do provide software products that include hardware engineers in the target market. These companies are Quilter and AllSpice.

Quilter #

Based on my reading of Quilter’s website, this looks to be an online based auto router for KiCad and Altium. User’s create schematics and board outlines with critical components already placed (connectors, etc.) and then upload their files to quilter which can place the remaining parts and do the layout. It looks like it uses some randomness in the generation because it generates multiple candidate layouts for you to pick through.

Overall, I feel pessimistic about this solution since it involves uploading circuit designs to a 3rd-party. This typically makes electronics companies uncomfortable, and with the value being an improved auto router (Hopefully saving development time, but potentially wasting it if results are not good like legacy auto routers) I’m not sure people will opt for this solution. It is currently in open beta so it sounds like there could be an opportunity to prove me wrong. In February 2024 it was reported that Quilter raised 10,000,000 in a series A, so some capital believes in their mission.

AllSpice #

AllSpice is an interesting product that attempts to modernize the ECAD workflow by utilizing Git and CI. They claim to support any ECAD format, from any device. Their website claims that they will work with you for an on-prem solution if you need it, but generally they have the same cloud draw back that Quilter has.

With that drawback out of the way - the value that AllSpice is trying to deliver is substantial. The current state of the Electronics CAD workflow makes it impossible to systematically highlight diffs, impossible to collaborate, forces you to manually copy files everywhere, and has many other drawbacks. AllSpice attempts to solve this by offering a git-based solution that understands the format of ECAD files. This way they can highlight differences, allow for web-based reviews of designs, and provide various other improvements. This topic has existed in the industry for some time and you should check out Andrew Shmakov’s presentation from KiCon 2019 if you want to see what the state of the art was in open source 5 years ago.

Crunchbase reports that Allspice raised $5,999,994 from 4 investors in an unknown series in July 2023.

Conclusion & files #

This concludes my brief adventure into Root’s portfolio companies. If you would like to poke at the data I collected yourself, download the excel sheet below.